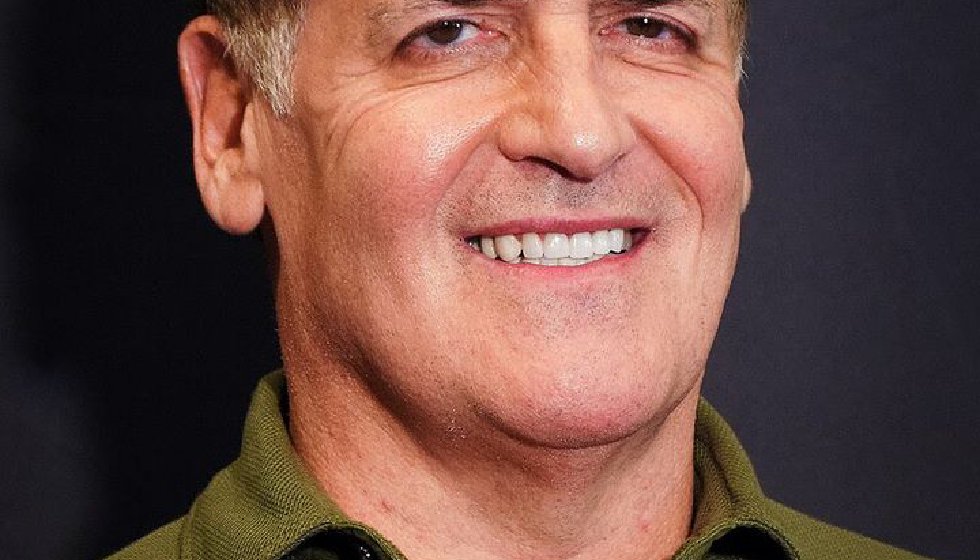

Mark Cuban has agreed to sell a majority stake in the Dallas Mavericks to Miriam Adelson, widow of the late casino magnate Sheldon Adelson, and her son-in-law, Patrick Dumont, for approximately $3.5 billion.

"The families are targeting a closing of the transaction by year-end, subject to the satisfaction of customary closing conditions and approval of the NBA Board of Governors," said the Adelson and Dumont families in a statement.

Cuban has been the primary owner of the Mavericks since 2000, when he acquired the team for $285 million. Under this new arrangement, Cuban will still retain a minority ownership share in the team and continue to oversee basketball operations, retaining influence in the team's day-to-day decision-making processes.

Dallas, once considered one of the underperforming franchises in professional sports during the 1990s, experienced an impressive transformation under Cuban's ownership. The team achieved notable success, including winning the 2011 NBA championship. The Mavericks also consistently performed well under Cuban, reaching the playoffs in all but six seasons.

Cuban is known for his fervor and hands-on approach to team management. His continued involvement aims to preserve the team's identity and culture and facilitate a seamless transition under the new ownership structure.

The timing of this ownership shift coincides with Cuban's announcement on the "All the Smoke" podcast that he will be departing ABC's "Shark Tank" after going for 16 seasons. His departure from the show comes after years of substantial investments in various entrepreneurial ventures.

Adelson family ventures into sports ownership

In the last decade, the NBA has experienced a surge in both popularity and revenue. The NBA's global reach and lucrative television deals make it an attractive investment opportunity for wealthy individuals and corporations seeking portfolio diversification.

Among those capitalizing on this trend is the Adelson family, renowned for their ownership of the Las Vegas Sands Corporation, the entity behind the Venetian and Palazzo resorts. Currently, the family focuses on casino operations in Macau and Singapore while also holding ownership of Nevada's largest newspaper, the Las Vegas Review-Journal.

Following the passing of Sheldon in 2021, the family is making strategic moves to sports ownership. On Tuesday, Sands disclosed the sale of $2 billion in company shares by Miriam, constituting approximately 10 percent of the family's stake to secure funds for the acquisition of a majority interest in a professional sports franchise.

"We have been advised by the selling stockholders that they currently intend to use the net proceeds from this offering, along with additional cash on hand, to fund the purchase of a majority interest in a professional sports franchise ... subject to customary league approvals," said the company in the SEC filing.

Considering the $2 billion stock sale, coupled with additional cash reserves, it is reported that the family could potentially acquire at least 57 percent of the NBA team. The Adelson and Dumont family would also hold the right to serve as the governor of the Mavericks.

Miriam is expected to retain a 51.3 percent ownership stake in the company following the share sale, as outlined in the filing.

The process of vetting new NBA owners typically spans several weeks, culminating in approval from the league's Board of Governors. Reports from The Dallas Morning News suggest that Cuban and Miriam are planning a collaborative venture involving a casino and arena in Dallas once gambling receives legalization approval in Texas.